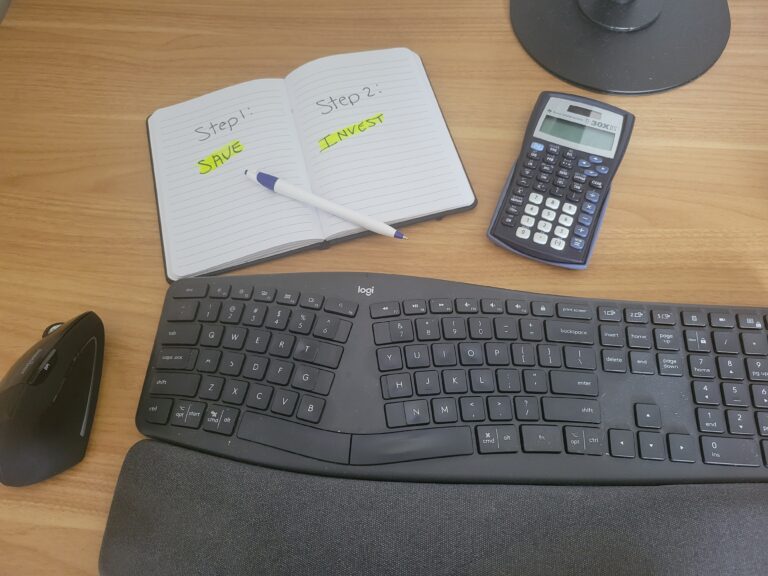

In my last post, I talked about the 2 steps to becoming financially independent. Saving more than you spend, and investing the rest. It’s a simple concept, but what if you don’t care to become financially independent? Typically when we think of saving and investing we relate it to retirement. But what if you don’t want to retire?

One of the things I hear often is from people who LOVE their job and plan on working forever! “What’s the point of saving for retirement if I love what I do and don’t want to quit?”. That’s a valid question. Saving in general might not seem necessary for some of you. The saying “you can’t take it with you when you go” gets tossed around quite often these days as well. Those things usually lead people to forgo saving and instead spending every dime they make, living paycheck to paycheck. So why save and invest if you don’t plan to retire then? I don’t want to sound bleak with some of these reasons, but not thinking about bad things doesn’t mean they wont happen. It just means you wont be prepared for when and if they do! Let me give you some reasons that might change your mind…

1. You become sick or disabled

We can be as safe as possible, always looking both ways before we cross the street. Always wearing a seatbelt. Eating healthy for every meal. But injury, accidents, and illness happen. Everyday in fact. It’ doesn’t matter how “safe” you think you are, you can still have something bad happen to you that you didn’t plan on.

Maybe you can go out on disability or collect insurance. But often that’s not enough. What if the disability forces you to leave your job!? How long before that insurance or SSDI runs out? If you have nothing saved, it’s absolutely going to make your life much more difficult. However, if you have been saving instead of spending, then you may have enough to quit your job and not have to worry about working through pain and discomfort!

What about illness? Even if it’s just short term, not everyone gets PTO or sick time to use. Wouldn’t it be nice to be able to take unpaid time off work when you are sick or ill!? If we talk long term, then again it may be necessary to leave your job in order to focus on your health. Ask anyone that’s done it and it’s a lot harder to do great work when dealing with an illness, especially a major one!

2. Your significant other becomes sick or disabled

Now maybe you are single (for now), but odds are most of you will have a significant other at some point in your life. The hope is that person will be healthy and fit and live a long and lovely life! Clearly that’s the goal we all have. To grow old and grey and pass away holding hands when were 95 years old. But the hard truth is, it’s almost certainly NOT going to happen that way.

What happens if your significant other has an injury that forces them to no longer be able to work!? Don’t think it could happen to you? Approximately 1 in 7 Americans between the ages of 35-65 will become disabled for at least 5 years (or longer). What would you do? Sure maybe you can just work extra hours or pick up a 2nd job to support the household. But that’s not always easy. What happens if the injury is so bad where your significant other needs care in the household because they can’t fully take care of themselves!? Paying for help certainly isn’t cheap! Wouldn’t it be nice to have enough money saved up so you can quit your job to stay home and take care of them!? That can happen if you are prepared and save and invest your money!

Along these same lines, maybe your significant other never gets injured on or off the job. But what happens if they get sick or god forbid get a disease that can’t be cured? Even if it can be cured, it doesn’t happen overnight. It takes time for people to get better. It also takes money and resources! Wouldn’t it be nice to quit your job and be the one who cares for your significant other while they are sick!? It can happen if you save and invest your money!

3. Your child/parent/friend becomes sick or disabled

Now I know it’s starting to get repetitive, but most of you probably have several other people that you care for. Children, parents, siblings, grandparents, aunts, uncles, cousins, friends…the list can go on forever. And I really wanted to show that there are so many different things that could happen to you or a loved one throughout the course of your lifetime that just may change your mind about saving and investing.

We certainly don’t think about bad things happening, but with the average lifespan being almost 78 years old, the odds are that something will happen. We just have to hope that something isn’t too bad. If and when something does happen, it may not require you to leave your job entirely, but wouldn’t it be nice to take a few weeks or a few months off work to care for that loved one? Wouldn’t it be nice to be so financially secure that you can help a loved one out with medical expenses if needed!? All off these things are possible if you save and invest your money!

4. You lose your job

Let’s change gears a bit, enough with the sick and injured talk! Ok this next thing isn’t all that much better. But some of you certainly plan on working forever. You absolutely love the career you are in and wouldn’t leave it no matter what! That’s great and all, but sometimes it just isn’t up to you!

Ask anyone that worked for Kodak or Polaroid, both were once thriving film companies at the very top of their market. But both failed to innovate with changing times and ended up filing for bankruptcy. Not familiar with those companies? How about Toys R Us, Pier One, or Bed Bath & Beyond!? Again, all were once sprawling retail stores with thousands of locations and tens of thousands of employees. All too filed for bankruptcy in the past 5 years.

Lastly, who doesn’t know Blockbuster!? At it’s peak, it had over 9,000 stores globally and made over $5.9 billion in revenue! But after filing for bankruptcy in 2010, today it is left with just 1 store. (Located in Bend Oregon for those of you wondering!) From 9,000 to 1. If it can happen to some the biggest companies in the world, then you should be able to see that no matter what industry or how big your company is, there is always the risk of it going under!

Even if it doesn’t close entirely, layoffs happen every single day. Companies downsize or restructure. They get new management that wants its own hand picked employees. The fact is, even if you WANT to work at your job forever, the longer you work, the less likely that is to happen! So that’s why you need to have money saved and invested! If you lose your job, wouldn’t it be nice to have a cushion while you pursue another!? Wouldn’t it be nice to take a little extra time off work and get back to something you LOVE rather than be forced to take the first job that pops up because you cant afford otherwise!? All of those things are possible when you save and invest your money!

5. You change your mind

Here’s a wild idea, what if you just so happen to change your mind!? If you start working at 18 and want to work your entire life, then the average person will end up working nearly 50 years! That’s a LONG time to be doing the 9-5 grind everyday! It certainly seems fun and easy in your 20s and 30s. But ask anyone in their 40s, 50s or 60s how fun it is. Sure, some of them still love it, but the older we get the more and more people start hopping on the retirement bandwagon.

If you planned on working forever, but get to the age of 50 and decide it’s no longer good for you, then what!? You don’t really have a choice if you haven’t been saving and investing! You will be forced to work another 10-15 years until Social Security kicks in (if it does). But if you have been saving and investing your whole life, then you have the FREEDOM to choose to retire when you want to! Sick of your boss at 45? Flip em the bird and walk out! Your spouse decides they want to vacation more and see the world at 55? Leave the grind and do what you love!

Maybe you decide you just want to spend more time with your kids or grandkids. Wouldn’t being outside with them, helping and watching them grow be a hell of a lot more fun than sitting in an office 5 days a week!? All of this is possible if you save and invest your money!

6. Fun Money

Hopefully you never have to worry about any of those bad things above. But the reality is, not everyone is that lucky. But to bring back some positivity, let’s pretend that none of these things happen in your 40+ year working career. Let’s pretend that you are healthy as can be and never get sick or disabled. Your children, parents, and significant other all remain in perfect health and never become sick or disabled. Let’s pretend you love your job for decades and it never gets cut. Let’s also pretend you never change your mind. If you have been saving and investing all those years in case something bad happens but it never does, then what!? Now you are stuck with millions of dollars. What are you supposed to do now!? Well I think we can all agree that’s a pretty awesome problem to have! Now is where things get fun and you can choose to do whatever you want with that money!

Maybe you are passionate about a certain charity. Now you have boat loads of cash to give to them! You can donate to your church, give it to your kids or grandkids. Help a neighbor. Hell, you can even get creative. How fun would it be to walk around your city just randomly handing out $100 bills because you have millions of dollars and nothing to do with it!? I personally can’t wait for the day I can go to the top of the tallest building and just let it rain down cash balls of money on the streets below! The fact is if you saved your money along the way and you never had to use it for any of the bleak things above, then you have lived a GREAT life and now you can help others. If helping others isn’t your thing, then fine, light your millions on fire in what would probably be the most epic YouTube video of all time! But seriously, help others at least a little bit first!

Final Thoughts

Whether you dream of retiring early or never retiring at all, one truth remains constant: life is unpredictable. The idea that saving and investing is only for those planning to retire misses the broader purpose of financial security. It’s not just about stopping work—it’s about creating options. It’s about being prepared for the unexpected, whether it’s illness, job loss, or simply a change of heart.

Building wealth isn’t just a retirement strategy—it’s a resilience strategy. It buys you time, freedom, and peace of mind when life throws curveballs. And if you’re lucky enough to go through life without needing that safety net? Then you’re in the enviable position of being able to give generously, explore freely, and enjoy life without limits.

So don’t save because you have to. Save because you can. Your future self—whether they’re 35, 55, or 85—will thank you for the foresight and the freedom you’ve built.

Tell me in the comments below, what are YOU saving and investing for!?